Cutler Commentary

3rd Quarter 2016 Market Commentary

October 11, 2016

Markets have not been particularly volatile this past quarter. Over the course of this bull market, we have had occasional sell-offs, mostly triggered by political actions (Greece, Brexit, Chinese Revaluation), but for the most part these have been few and far between. On September 30th, the S&P 500 sat only 1.1% below its all-time high. The Dow Jones Industrial Average similarly was just 2.2% from its all-time high. Bonds are still near their highs; interest rates near their lows. Emerging markets have recovered. Oil is significantly off of its lows.

And yet, investors are nervous.

Investors seem to distrust the current market, including professional money managers. A September survey of fund managers by Blackrock resulted in an average cash position of 5.5%. In February, this same survey showed average cash of 5.6%, the highest levels since 2001! Professional investors are holding cash as a cushion from a market drop. Interestingly, when investors all increase their cash positions, it has historically been a “buy” signal.

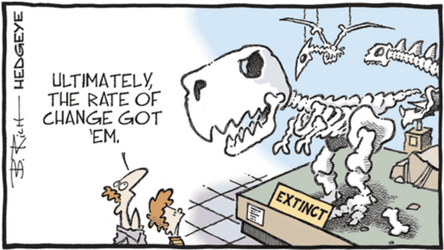

Why do investors distrust the market? Perhaps it is the election, which rightfully makes us all nervous. Perhaps it is the Fed, which has continued to hint that an increase might one day be just over the horizon. In our view, it is most likely fatigue. This bull market is nearing 8 years old. The “easy money” has been made, and investors are more concerned with preserving capital, than in modest gains.

But, consider this. The S&P 500 is on pace to finish higher for the 31st year of the past 37. As money managers, we are constantly asked whether clients should raise some cash at these levels. For the short-term investor, sure, go ahead. However, most investors have a time horizon beyond the next 12-18 months. If the past is any indication, the smart decision is to continue to stay invested.

Equity Income Commentary

After a very strong first half in 2016, Cutler’s Equity Income strategy “gave back” some of the year-to-date’s outperformance in the 3rd Quarter. The Equity Income Composite returned 1.57% (gross), 1.39% (net), versus the S&P 500 TR at 3.85%. Much of that difference can be attributed to one holding, Bristol-Myers-Squibb (BMY) which was down 26%. BMY suffered a pipeline set-back as their flagship cancer drug, Opdivo, failed to meet testing benchmarks for lung cancer. This ceded to Merck the market dominance in the immuno-oncology space, and Merck’s stock rallied on the news. Pharmaceuticals will always be dependent on drug development, and set backs will occur for any company. However, companies with great balance sheets can weather these challenges. This is largely why we are biased toward companies with strong cash flows and dividends, attributes less dependent on FDA approval!

The best performing position this past quarter was Qualcomm, up 28.95%. The next largest contributor was Texas Instruments, a holding also in the semi-conductor industry. The semi-conductor space has been ripe with rumors of consolidation, a development that could create synergies and save costs.

Lastly, we should note a material change occurred this past quarter in the S&P 500. Real estate, which had previously been included in the financial sector, is now defined as a separate sector in the benchmark index. Historically, Cutler has not invested into publicly traded real estate, despite the rich dividends frequently available in this space. For example, we sold Weyerhaeuser when it converted to a REIT structure. For now, we continue to hold off and have a 0% weighting versus the benchmark of 3.2%. We are, however, going to look for opportunities in this sector to include in Cutler’s Approved List going forward. If an Approved List position is deemed suitable, it may be added to the portfolio.

Past performance is no guarantee of future results. All investments involve risk, including possible loss of principal amount invested. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be profitable or suitable for a particular investor's financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses.

All opinions and data included in this commentary are as of October 7, 2016 and are subject to change. The opinions and views expresses herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This report is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 7.8 trillion benchmarked to the index, with index assets comprising approximately USD 2.2 trillion of this total. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. This index is not available for direct investment.

| TOP 5 AND BOTTOM 5 HOLDINGS BY PERFORMANCE - AS OF 9.30.16 | ||

| Best Performing Securities | Average Weight (%) | Security Contribution to Portfolio Return (%) |

| Qualcomm Inc. | 2.53 | 0.66 |

| Caterpillar Inc. | 2.66 | 0.46 |

| Intel Corp. | 2.82 | 0.43 |

| Microsoft Corp. | 3.44 | 0.43 |

| Texas Instruments Inc. | 4.13 | 0.48 |

| Worst Performing Securities | Average Weight (%) | Security Contribution to Portfolio Return (%) |

| Bristol-Myers Squibb Company | 3.85 | -1.14 |

| Exxon Mobil Corp. | 3.38 | -0.22 |

| Verizon Communications Inc. | 3.31 | -0.21 |

| AT&T Inc. | 3.47 | -0.18 |

| Walt Disney Co. | 3.59 | -0.16 |

The performance information shown above has been calculated using the composite managed by the firm in the Equity Income strategy. Information on the methodology used to calculate the performance information and a list reflecting the contribution of all the holdings in the composite to the composite's overall performance during the time period reflected above, is available upon request.

Holdings are subject to change. Cutler Investment Counsel, LLC or one or more of its officers, may have a position in the securities discussed herein and may purchase or sell such securities from time to time.

Equity Income Composite Annual Disclosure Presentation

CATEGORIES

Disclaimer

These blogs are provided for informational purposes only and represent Cutler Investment Group’s (“Cutler”) views as of the date of posting. Such views are subject to change at any point without notice. The information in the blogs should not be considered investment advice or a recommendation to buy or sell any types of securities. Some of the information provided has been obtained from third party sources believed to be reliable but such information is not guaranteed. Cutler has not taken into account the investment objectives, financial situation or particular needs of any individual investor. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor's financial situation or risk tolerance. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary. No reliance should be placed on, and no guarantee should be assumed from, any such statements or forecasts when making any investment decision.