Cutler Commentary

The Bull Market Turns 8

April 13, 2017

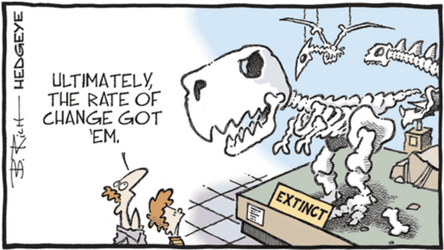

Stocks recently celebrated the 8th anniversary of the current bull market. For investors, this is unequivocally a good thing. Stocks are supposed to rally! However, as with any sustained rally, temptation can become an investor’s Achilles heel. And, especially with valuations at the highs of the bull market, investors must remain focused on their process. For Cutler, nothing is more important to us in today’s market than “discipline.” Cutler continues to manage portfolios in accordance with our discipline. A strong dividend history and relative value are central to our process. We look for great companies that we are comfortable holding for the long-term. With so much uncertainty for today’s investors, discipline is more important than ever.

The market response to the November election was exceptional. The sharp rally in equities was accompanied by a drop in bond prices, as investors weighed an era of deregulation, tax reform, and infrastructure spending. Financials, reacting to a potential repeal of Dodd-Frank, rallied significantly. Small-cap stocks returned 8.43% in the 4th quarter and 2.12% in the 1st quarter (as measured by the Russell 2000), implying investors had a very significant appetite for risk. Industrial stocks, such as Caterpillar, moved up anticipating global commodity inflation and infrastructure spending.

While the market rally appeared to continue into 2017, a funny thing happened as we blew past Dow 20,000. Leadership changed. Technology stocks and the wider growth indices led the market higher. This is reminiscent of the past few years, where FANG (aka Facebook, Amazon, Netflix, Google) stocks dominated market returns. Perhaps the best example of this shift, Apple alone is up 23.83% this year (through 4/10/17), adding $179.29B in market capitalization. Only 34 stocks in the US markets have a total market capitalization greater than $150B!

What is this market shift telling us? Perhaps it is implying a lack of confidence in a complete policy upheaval that would benefit Financials and Industrial stocks. Perhaps it is implying a period of economic growth similar to the past few years. Or, quite possibly, it may simply represent a rotation after strong value stock performance in 2016.

Equity Income Update:

After outperforming in 2016, Cutler’s Equity Income strategy underperformed in the 1st Quarter returning 1.5% (gross) and 1.3% (net) versus the S&P 500 TR return of 6%. This can partly be explained by the shift from value to growth in the quarter. However, this can also be explained by a few untimely exposures in the portfolio, notably retail. Retail has had a very challenging first quarter. Already this year, 9 brick-and-mortar retailers have filed for bankruptcy protection. Despite rising consumer confidence and a recent uptick in debt (meaning, more spending), brick-and-mortar retail has seen continued declines. However, this has not been universal. Walmart, staying true to its price competitive business strategy, has been performing as expected in a slow growing economy (a portfolio holding up 6.21% through 4/10/17). Target, however, had an earnings report that caused investors to worry and the stock sold off 22% in the quarter. This was the Equity Income strategy’s worst performing stock in the period. Will we continue to hold this position? Historically, Cutler has been reticent to sell into bad news, and instead “let the dust settle.” A great deal of the earnings bad news was Target investing $7 billion to upgrade their stores. You may recall Walmart going through a similar transition just a few years ago. Today, Target’s stock is supported by a 4.3% dividend yield that is well-covered by earnings. At least for now, Target is not the next Sears, however, we will continue to address this position in the context of the portfolio and Cutler’s Approved List. If a more attractive opportunity exists, we won’t hesitate to make a change.

Becton, Dickinson & Co. (+11.25%), Texas Instruments (11.11%), and The Home Depot (10.18%) were the strongest performers in the quarter. Texas Instruments has been notable, as the company continues to attract institutional buyers and, from 2007 through 2016, Texas Instruments has invested $32 billion into research and development, sales, marketing and capital spending. Additionally, it spent $25 billion on share repurchases and $9 billion on dividends. We believe this company continues to be one of the most attractive firms in the semiconductor space.

All opinions and data included in this commentary are as of April 11, 2017 and are subject to change. The opinions and views expresses herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This report is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 7.8 trillion benchmarked to the index, with index assets comprising approximately USD 2.2 trillion of this total. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. This index is not available for direct investment.

| TOP 5 AND BOTTOM 5 HOLDINGS BY PERFORMANCE - AS OF 3.31.17 | ||

| Best Performing Securities | Average Weight (%) | Security Contribution to Portfolio Return (%) |

| Becton, Dickinson and Co | 3.46 | 0.38 |

| Texas Instruments Inc. | 4.4 | 0.50 |

| The Home Depot Inc | 4.09 | 0.42 |

| E.I. du Pont de Nemours & Co | 3.24 | 0.33 |

| Johnson & Johnson | 3.12 | 0.28 |

| Worst Performing Securities | Average Weight (%) | Security Contribution to Portfolio Return (%) |

| Target Corp | 2.63 | -0.70 |

| The Kroger Co | 2.09 | -0.32 |

| Qualcomm Inc | 2.35 | -0.30 |

| Exxon Mobil Corp | 3.03 | -0.28 |

| Chevron Corp | 3.52 | -0.30 |

The performance information shown above has been calculated using the composite managed by the firm in the Equity Income strategy. Information on the methodology used to calculate the performance information and a list reflecting the contribution of all the holdings in the composite to the composite's overall performance during the time period reflected above, is available upon request.

Holdings are subject to change. Cutler Investment Counsel, LLC or one or more of its officers, may have a position in the securities discussed herein and may purchase or sell such securities from time to time.

CATEGORIES

Disclaimer

These blogs are provided for informational purposes only and represent Cutler Investment Group’s (“Cutler”) views as of the date of posting. Such views are subject to change at any point without notice. The information in the blogs should not be considered investment advice or a recommendation to buy or sell any types of securities. Some of the information provided has been obtained from third party sources believed to be reliable but such information is not guaranteed. Cutler has not taken into account the investment objectives, financial situation or particular needs of any individual investor. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor's financial situation or risk tolerance. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary. No reliance should be placed on, and no guarantee should be assumed from, any such statements or forecasts when making any investment decision.