Cutler Commentary

1st Quarter 2023 Market Newsletter

April 17, 2023

If It’s Broken, It Can Be Fixed

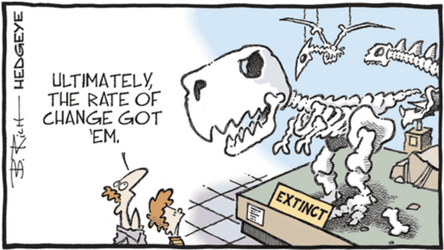

What a tightrope the Federal Reserve is walking! After a belated Federal Reserve rate hike cycle (remember, “transitory inflation”?), the Fed has been playing catch-up for much of the past year. The goal, of course, is to tame inflation while avoiding a recession. However, in the March minutes of their meeting, even the Board of Governors of the Federal Reserve acknowledged that a third quarter recession is a likely outcome. The tightrope, then, has become how to make any recession as painless as possible.

In the first quarter of 2023, the tightrope got even shakier. Wall Street often says that “the Fed will raise rates until something breaks,” and in Q1 we saw the second largest bank collapse in domestic history when Silicon Valley Bank (SVB) was shuttered midday on a Friday. Signature Bank and Credit Suisse (a 166 year old bank) also subsequently failed. While these banks shared a common thread of very poor risk management, they were also victim of rapidly rising rates. Specifically, depositors moved their money out of very low yield savings accounts and into far higher yielding instruments like a money market fund. This should not be a surprise; at Cutler we have been actively advising clients to move cash into higher yielding alternatives to savings accounts.

While the initial reaction to this bank run was broad selling in stocks, swift moves to backstop banks provided some stability. The Fed had enough confidence in these backstops to raise rates again in March, believing that the risks of higher inflation outweighed a precarious economic outlook. With interest rates pricing in a recession later this year, rate expectations are near their peak, and lower rates are forecast beginning this summer.

The possibility for lower rates has led to a big rally in Growth-style stocks. The tech-heavy Nasdaq 100 index has led the way higher. Why has that index rallied so strongly? Partly because the “tech giants” were beaten down so hard in 2022, and partly because there is a trend towards viewing these mega-cap companies as a flight to “safety”- while they can trade at high valuations and be quite volatile, they can also offer wide moats to competition and strong pricing power. How narrow is the stock leaderboard? Only 3 out of 11 sectors outpaced the broad S&P index in the first quarter, and those sectors are highly concentrated as follows:

- Technology (45% constituted by Apple and Microsoft)

- Consumer Discretionary (40% constituted by Amazon and Tesla)

- Communications (50% constituted by Google and Meta/Facebook).

The wild set of events in March resulted in a first quarter where both bonds and stocks finished positive, which was a relief after the gloom of 2022. The yield curve is still inverted (historically a recession indicator), but the pricing pressures to buy up shorter bonds has actually led to that curve flattening a bit. Meanwhile, foreign developed markets actually outpaced the S&P 500. The world’s central banks continue to increase rates, but most lending rates are still below the US- even while their inflation is generally higher. This relatively accommodative positioning, a weaker US dollar, and broadly lower valuations, have driven upside versus broad domestic indexes for two straight quarters now. We are also seeing some upside from the China reopening process, even as their stated growth numbers come in below recent history. If China recovers this year, it could be a boon to commodities prices which have been broadly lower due to slower global growth.

Looking ahead, the Fed will continue to walk a delicate tightrope between taming ongoing elevated inflation and keeping the economy moving forward. As stated before, we do expect that a mild and short recession will happen- but events like the bank crisis show that the full range of consequences are hard to forecast. Policy actions can also exacerbate problems, like inflation, resulting in whack-a-mole monetary policy. To be fair, the Fed is making progress as both headline and core inflation measures are down from the 2022 summer peaks. A faction of investors believe that the Fed will cut rates aggressively, but so far the Fed governors have shown very little inclination to follow that path. Cutler’s position is that the Fed will be hesitant to cut rates until inflation has come back in-line, meaning short-duration bonds are still relatively attractive.

With cash rates above their recent norms, equity investors are forced to ask if market participation continues to make sense. This first quarter provided a resounding response to that question, as even in the face of a banking crisis, a forecasted recession, and persistent rate increases the S&P 500 managed positive returns. As we’ve mentioned in the past, most investors are best served by not trying to pick tops or bottoms of markets. As we move forward, market upside is difficult for a very concentrated number of companies to sustain, no matter how big those companies are. We would look for new leadership to emerge as the year progresses.

Asset Class Review

In 2022 our bias towards high quality, Value-style stocks provided significant relative benefits. The first quarter of 2023 saw a sharp reversal in that trend, with the very limited leadership noted before carrying the “mega-cap” Growth-style names to wide outperformance versus Value. The Nasdaq 100 index gained almost 20% for the quarter, while the broad S&P gained a solid- but obviously lower- 7.5%. In mid-March the Nasdaq was up just 8%. Markets seem convinced that easing monetary conditions are on the way.

Fixed Income had an eventful but positive quarter with the broad Aggregate index gaining almost 3% after an historically awful 2022. The yield curve remains inverted, and we continue to see more upside in the shorter end of that curve while it remains so, but we could see benefit to lengthening duration as the year progresses if the curve normalizes. If we do see recession signals increasing, the flight to bonds could increase as investors seek to increase relative safety.

Foreign developed stocks again outpaced broad domestic stocks, with a sharp rally to finish the quarter up about 8.5%. Even as they grapple with their own inflation and domestic issues, we continue to see upside potential in this class. The Emerging Markets class also provided upside in the quarter as China continues to reopen. The lower rate trajectory and slower economic growth in the US may lead to a weaker dollar that could benefit international positions.

While not as pronounced as in 2022, alternatives allocations continued to be a source of stability in portfolio allocations. Our standard “alts” position, the Goldman Sachs Absolute Return Tracker fund, gained about 3% for the quarter. We continue to appreciate the true diversification benefits of this class.

Commodities have been a mixed bag. Oil futures were broadly negative for the quarter, but did see some rally on China reopening news, an announced OPEC cut, and some speculation that the US would look to begin restocking the heavily depleted Strategic Petroleum Reserve. Agricultural commodities were fairly benign for the quarter, although food remains a significant source of inflationary pressures. Inflationary “hedge” trades did well this quarter. Gold staged a strong rally for the quarter and reached the $2,000 per ounce mark as the period ended. Bitcoin had a huge rally in the quarter to come off recent low marks, as some investors increased their willingness to speculate. We continue to advocate the benefits of owning stocks, investments that we see as intrinsically creating value, versus these investments that are predominantly speculative.

Past performance is not indicative of future results. Strategies referenced herein may be materially different than actual positions held in client accounts. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be profitable or suitable for a particular investor's financial situation or risk tolerance. Investing involves risk, including loss of principal. You cannot invest directly in an index. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

The Barclay's Aggregate Bond Index (Taxable Bond) is a broad base, market capitalization weighted bond market index representing intermediate term investment grade bonds traded in the United States.

Headline Inflation is the raw inflation figure reported through the Consumer Price Index (CPI) that is released monthly by the Bureau of Labor Statistics.

The Bloomberg Commodity Index (Commodities) is an index of the prices of items such as wheat, corn, soybeans, coffee, sugar, cocoa, hogs, cotton, cattle, oil, natural gas, aluminum, copper, lead, nickel, zinc, gold and silver. The index is calculated on an excess return basis and reflects commodity futures price movements.

The MSCI EAFE Index (Foreign Developed Index) is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada.

The MSCI Emerging Markets Index captures large and mid-cap representation across 27 Emerging Markets (EM) countries. With 1,392 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Bitcoin Each crypto index is made up of a selection of cryptocurrencies, grouped together and weighted by market capitalization (market cap). The market cap of a cryptocurrency is calculated by multiplying the number of units of a specific coin by its current market value against the US dollar.

Source: Morningstar All opinions and data included in this commentary are as of March 31, 2023 and are subject to change. The opinions and views expressed herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This report is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed.

CATEGORIES

Disclaimer

These blogs are provided for informational purposes only and represent Cutler Investment Group’s (“Cutler”) views as of the date of posting. Such views are subject to change at any point without notice. The information in the blogs should not be considered investment advice or a recommendation to buy or sell any types of securities. Some of the information provided has been obtained from third party sources believed to be reliable but such information is not guaranteed. Cutler has not taken into account the investment objectives, financial situation or particular needs of any individual investor. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor's financial situation or risk tolerance. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary. No reliance should be placed on, and no guarantee should be assumed from, any such statements or forecasts when making any investment decision.